[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Learning Objectives [/heading]

-

To clarify the difference between Saving vs. Investing

-

To explain the concepts of ‘interest’ and ‘compounding interest’

-

To explain growth through investing and the risks involved

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Saving and Investing [/heading]

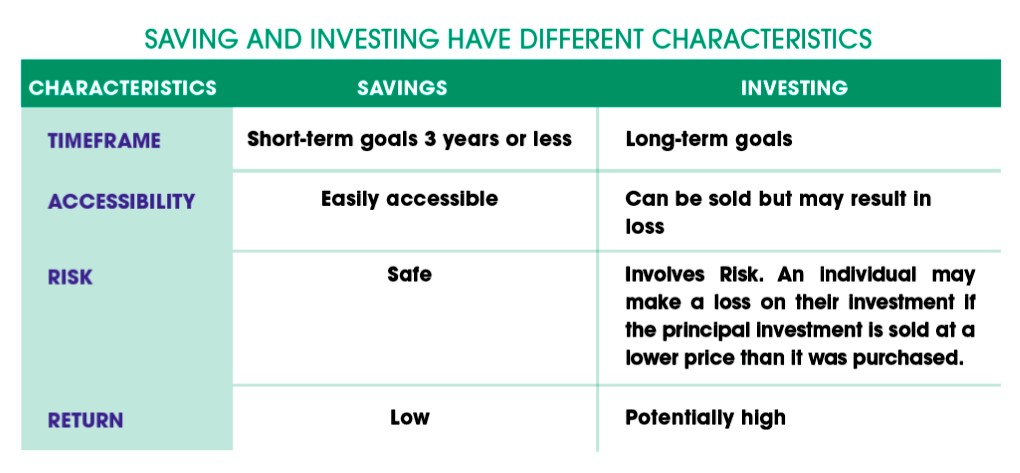

Saving is the act of putting aside money you earn, or receive as gifts, for another day or short term. Investing is the act of choosing products and strategies to make that money grow in the long term.

Investing is usually more appropriate for mid-term and long-term goals, which are usually costlier. You invest in order to:

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Saving for the Future [/heading]

There are various ways to save. How many of you save? Where do you save your money?

One way to save is to open one or more deposit accounts, such as a chequing or savings account, in a bank or credit union — a financial institution. Deposit accounts give you ready access to your money, and your account balances are typically insured by the Deposit Insurance Company (DIC) up to $125,000. The Deposit Insurance Corporation (DIC) was established by the Central Bank and Financial Institutions (Non-Banking) (Amendment) Act, 1986. The DIC plays a critical role in contributing to the continued stability of Trinidad and Tobago’s financial system as a whole. Its main function is to manage a Fund to provide insurance protection for depositors against the potential loss of their deposits should a member financial institution fail.

Saving and investing can be the keys to achieving specific financial goals – that will cost money — such as purchasing a car or a home, paying for college or building a secure retirement. Once you get into the savings habit and you have a pool of money set aside, you need to put your money to work for you, to grow your savings. That is what we call investing.

Seeking growth through investing

If you are willing to take a certain amount of risk with the money you have saved, you can use it to make investments that you expect to be worth more in the future. Investments are volatile – the value of the investment rises and falls over time.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Three major types of Investments [/heading]

- Investment in securities – Shares in a company (stocks, mutual funds that invest in stocks, etc.)

- Property (real estate, art, precious metals, etc.)

- Direct investment in a business

The best known securities investments and which are regulated (legally structured and managed) in Trinidad and Tobago are:

| Stocks, or equities | Bonds | Mutual funds |

| which give you part ownership or shares in a corporation. | which when purchased, are a loan to a specific entity, which promises (but usually doesn’t guarantee) repayment of the money you invest, plus interest for the use of that money. The ‘issuer’ (the entity selling the bond) of the bond agrees to pay the buyer of the bond a specified rate of interest for a pre-determined length of time. The issuer will repay the face value of the bond (the principal) when it “matures,” or comes due. | which are pooled investment vehicles that invest in stocks, bonds or other financial instruments.

These terms and concepts will be further explained in the following Unit. |

Of note is that over a long period (five or more years) investments tend to grow faster than savings. You should never invest until after you have adequate savings (at least three to six months of income to cover your living expenses).

Higher expected returns are accompanied by higher risk. By investing, you take the risk that the investments you choose may not live up to your expectations, or that troubles in the marketplace may depress investment prices. You can have a loss if you sell your investment for less than you paid for it. In a worst-case scenario, your investment might lose all its value. You can limit your risk, however, by choosing a well-diversified mix of investments. There are many things of value that you might choose to buy because you expect them to provide a profit, but the term “investment” here is described as products that are traded in an organised and regulated marketplace.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Return on Investmenet [/heading]

Investment return is what you get back on an investment you made.

Ideally, the return will be positive, your initial investment or principal will remain intact, and you will end up with more than you invested. But because investing typically involves risk, your returns can be negative, and you can wind up with less money than you initially invested.

For example, let’s say you buy a stock for $30 a share and sell it for $35 a share. Your return is $5 a share minus any commission or other fees you paid when you bought and sold the stock. If the stock had paid a dividend of $1 per share while you owned it, your total return would be a gain of $6 a share before expenses.

However, if you bought the stock at $35 and sold it at $30, you would have lost $5 on your investment, not counting expenses. If you earned a dividend of $1 per share, your actual loss would be reduced to $4 a share.

Total return = gain or loss in value + investment earnings (dividend)

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Time and your portfolio[/heading]

Time helps you to withstand the risks that accompany higher expected returns from investing in stocks, bonds or mutual funds. Most importantly, time allows you to recover from the potential short term losses.

Time can be important in several ways. Time can:

- Give you the freedom to take risks.

- Let your investments compound, or grow in value.

- Make it possible to plan for long-term investment goals, which are often the biggest and most challenging to meet.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Compounding [/heading]

Compounding is what happens when your investment earnings or income are reinvested and added to your principal, forming a larger base on which earnings can accumulate.

The larger your investment base or principal grows, the greater the earnings your investment can potentially generate. So the longer you have to invest, the more you can potentially benefit from compounding.

Example. Someone gives you a cheque for $1000. You forget it for a year. At the end of the year the cash value is still $1000.

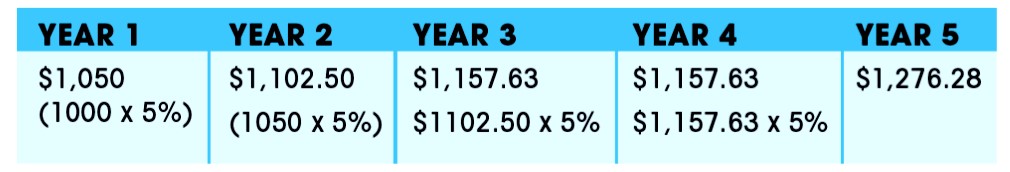

If you deposit in an account paying 5% interest, at the end of the year you should have – $1,050

If you left the money at a fixed rate of 5 %, for 5 years, you would have $1,276.28 at the end of five years. You would have earned – $276.28 – Which is your compounded interest.