A Mutual Fund is a collective investment scheme that pools investors monies to form the source for investments in various securities depending upon the investment objective of the scheme eg. equities, bonds, money market instruments, other financial securities.

For investors who would like to invest in mutual funds, where do they start?

The number of funds is so large and investment programs so varied, that investors could become overwhelmed.

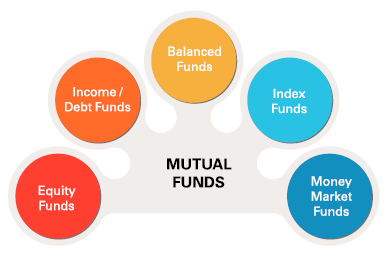

Generally speaking, there are four broad types of mutual funds; equity funds, fixed-income funds, money market funds and balanced or hybrid funds.

Every mutual fund is designed to spread around risk while capturing wider market gains. Some types of funds carry a higher amount of risk than others, but also higher potential rewards.

Here’s a more detailed look at the most common types of mutual funds, starting from the higher to the lower risk funds.

EQUITY OR GROWTH FUND

As the name suggests, this portfolio is mandated to invest mostly in common stocks. These funds are considered riskier than the other type of funds and are used for growing your investment as they usually provide a higher return.

This type of fund is more suited to the aggressive investor who is willing to accept a little more risk.

The younger investors should include equity funds in their portfolios as they have more time to weather inevitable ups and downs in market value.

FIXED INCOME OR BOND FUNDS

These funds invest in government and corporate debt. They are considered a safer investment than stocks. Fixed Income funds are less risky than growth funds, and suitable for investors in need of regular periodical income.

Investors nearing retirement should have more fixed income funds in their portfolio to protect their nest egg while earning a higher interest than traditional savings and fixed deposit accounts.

BALANCE OR HYBRID FUNDS

These investments are a combination of equity and fixed-income funds with a fixed ratio of investments, for example 60% stocks and 40% bonds.

This type of fund is best suited to the investors who is willing to assume some level of risk to achieve a growth in capital, but who also want to maintain a moderate level of current income.

These funds are popular with younger investors who usually have longer investment horizons and a relatively moderate appetite for risk.

MONEY MARKET FUNDS

Money Market funds are fixed-income mutual funds that invest in high-quality, short-term debt from governments, banks or corporations. Examples of assets held by these funds include Treasury Bills, Certificates of Deposit and Commercial Paper. They are considered one of the safest investments.

Money Market Funds are for conservative investors with a short-term horizon whether storing money for emergencies, short-term savings, or looking for a place to store cash from the sale of an investment. It aims at providing easy liquidity, preservation of capital and moderate income.

OTHER TYPE OF FUNDS

INDEX FUNDS

An index fund is a type of mutual fund whose holdings match or track a particular market index, such as the S&P 500. Index funds. The Fund is structured by purchasing small amounts of each stock of the index.

COUNTRY GENERIC

Some Mutual Funds are country generic, investing in a particular country or group of

countries e.g. Asia, North America, South America, Europe etc.

SECTOR SPECIFIC

Mutual Funds are also sector specific. These funds choose to invest in a particular industry or segment of the market e.g. the energy sector. Sector funds are considered less diversified than most mutual funds, but they do offer diversification within a particular industry.

Looking at funds by objective s is part of the investor process.

What kind of investor are you?

- What is your risk profile – high, moderate or low?

- What goals are you trying to achieve?

- This would guide you in what type of funds to invest in.

Article by the: Mutual Funds Association of Trinidad and Tobago

Registered Address:

Mutual Fund Association of Trinidad and Tobago

UTC Financial Centre

No. 82 Independence Square ,Port of Spain, Trinidad

Telephone: (868) 625-8648

Fax: (868) 625-5627

Website: http://mfatt.org