[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Creating an Investor Profile[/heading]

In our last post, we discussed the basics of investing, setting financial goals and deciding on the type of investment that may best suit you. In this post, we’ll focus on creating your personal investor profile and guide you through the process of selecting an investment option that will help you achieve your financial goals.

Investor Profile

An investor profile is an outline of what your preference is when it comes to investing. Key considerations to note when creating your investor profile are your nature, circumstances and risk tolerance.

1. Know yourself and understand what is important to you.

Success would usually depend on ensuring that your investment strategy fits your personal characteristics. No investor is the same; each investor comes from a unique background and has specific needs relative to their own individual goals. Therefore, you should always pay attention to both your investment objectives and your personality. As Warren Buffet says, “Never invest in a business you can’t understand…Only buy something that you’d be perfectly happy to hold if the market shuts down for 10 years.”

2. Investment Objectives.

A multi-millionaire is obviously going to have different financial goals than let’s say a newly married couple just starting out. The millionaire, in an effort to increase his wealth further, will have no qualms about investing $1,000,000 in the real estate market, as he can clearly afford the risk. However, the married couple’s primary focus will likely be on having a strong savings pool to make the down payment for their first house. In this instance, every cent will count and the couple cannot afford the risk of losing their money in a speculative venture. So always consider where YOU are in your particular life stage and weigh both the costs and benefits for your long and short-term objectives.

3. Personality.

Your personality traits may determine how much volatility you are willing to experience in your investments or your desire to research investments. Some people love nothing more than digging into financial statements and crunching numbers. To others, the terms balance sheet, income statement and stock analysis may sound overwhelming and off putting.

As referenced in part 1 on of our investing 101 blog, a key determinant of what investment may work best for you is your individual risk tolerance.

What are your investment options?

Now that you are aware of your investor profile, the next question is “which investment product(s) should I use?” Keep in mind the old adage, “Don’t put all your eggs in one basket”. We recommend using a multi-faceted approach to investing so that if something goes wrong with one product, you don’t lose all of your money. Therefore, it is prudent to have diverse types, a wide variety, of investments in your portfolio.

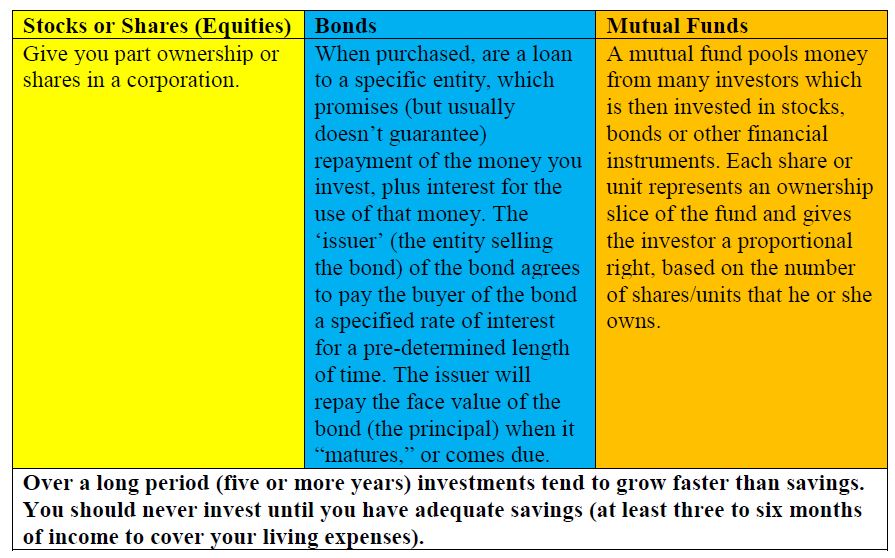

The three (3) major types of investment products available locally which the TTSEC regulates and which you can consider are:

- Equities (stocks/shares)

- Bonds

- Mutual funds

Here is a simplified explanation of these investment products:

Stocks/Shares

A stock is a collection of shares. A share is a security (financial instrument) that represents ownership in a corporation. A stock refers to the ownership of a corporation represented by the number of shares purchased. Essentially when you purchase a stock or share you become a part owner of the business. This entitles you to the right to vote at the shareholders’ annual general meeting and allows you to receive any profits that the company allocates to its owners. These profits are referred to as dividends. Stocks are volatile. That is, they fluctuate in value on a daily basis. When you buy a stock, you are not guaranteed anything. Many stocks don’t even pay dividends, in which case, the only way that you can make money is if the stock increases in value. When the stock price increases and is more than what you initially paid for it, you can make a capital gain, should you decide to sell the stock. It is also important to note as well that you can sustain a capital loss if the stock decreases in value.

Check out this video from the Trinidad and Tobago Stock Exchange Limited:

Bonds

A bond is a debt instrument issued by a private corporation or government agency to raise money for various long-term projects. The investor is thus “lending” money to a company or a government for a specific project or projects for a specified period. Periodic interest payments are made at pre-identified times and the “loan” is paid in full at maturity (the end of the loan period).

Image Source: BBA Lectures

Mutual Funds

A mutual fund is a collection of stocks and bonds and each investor in the fund owns shares or units, which represent a portion of the holdings of the fund. A mutual fund collates or “pools” money from the many investors to purchase a diverse mix of securities and has a full-time investment fund manager to make and monitor investments.

The types of securities that a particular fund invest in are identified for the benefit of investors in the fund’s prospectus (description of the investment or securities), which is a legal document, required by and filed with the TTSEC.

Image Source: Topyups

Popular investments which are regulated (legally structured and managed) in Trinidad and Tobago are:

Before confirming any investment decision, you should also undertake these steps:

- Obtain written documents detailing the nature of the investment;

- Read and understand those documents;

- Verify the legitimacy of the investment;

- Deal only with registered financial institutions and intermediaries; and

- Find out your options if something goes wrong.

The TTSEC’s Investor Education programme also offers you the opportunity to participate in a virtual market prior to investing via its investing game Investor Quest TT (IQTT) – https://www.investorquest-tt.com . IQTT is free and open to all members of the public and provides a safe online environment where you can get a feel for what it may be like, should you decide to venture into the real world of investing.

Investing is not as difficult as it may seem and is actually a good way to make your money grow and work for you. Once you do your due diligence, follow some of the steps we have outlined and exercise your rights and responsibilities as an investor. Next week, we will share information about some of the warning signs and red flags of investing that you should look out for especially in these challenging times.

Visit our website at ttsec.org.tt to view the full list of registered investment advisors, broker dealers and investment products. Before investing, educate and empower yourself so you can invest with confidence!

You Invest. We Protect. Everyone Benefits.

For more information and regular updates and investor education tips connect with us via any of our social media handles: