Fraud is fraud! No matter how you categorise it, or how it is packaged, you have a responsibility to recognise it before you are duped out of your hard-earned money. There are different types of fraud and financial fraud is a serious issue. In this article we discuss Affinity fraud.

Affinity Fraud

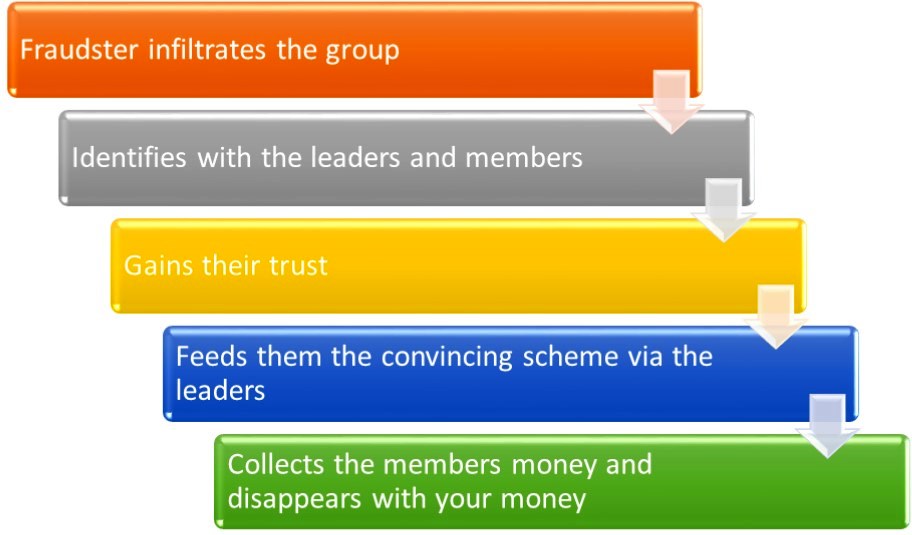

Affinity fraud refers to investment scams that prey upon members of identifiable groups, such as religious or ethnic communities, the elderly, retiree groups or professional groups. These fraudsters frequently are, or pretend to be, members of the group. They often recruit respected community or religious leaders from within the group, to spread the word about the investment scheme, by convincing the members that a fraudulent investment is legitimate and worthwhile. Many times, those leaders become unwitting victims of the fraudster’s ruse.

Stages of being defrauded:

These clever fraudsters go all out and may often volunteer with the group, attend social events and build trusting relationships with group leaders to gain acceptance and endorsement. Once they have established strong relationships, they convince people to invest in their scheme.

A common type of affinity fraud is a Ponzi or pyramid scheme where new investor money is used to pay earlier investors, making it appear as if the investment is successful and legitimate. These schemes promise everything from making big money working from home, to turning $100 into $10,000 in just six weeks. You may also be given the chance or ‘opportunity’ to join a special group of investors who are going to ‘get rich quick’ on a great investment.

These scams basically exploit the trust and friendship that exists in groups of people, and many times, because of the tight-knit structure of many groups, outsiders may not know about the affinity scam. Victims may try to work things out within the group rather than notify authorities or pursue legal action.

You have a responsibility to recognise common traits among fraudsters or characteristics of fraudulent activity and report your observations to the T&T Securities and Exchange Commission – complaints@ttsec.org.tt. In our next article we tell you what to look out for and ways in which you can minimise your risk of being defrauded.

END

Adapted from: https://www.investor.gov/additional-resources/news-alerts/alerts-bulletins/investor-bulletin-affinity-fraud