[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Avoiding Scams[/heading]

In our two previous Blogs we shared some of the tools that you can use to get started with investing, as a means of making your money work for you. We focused on some of the available resources on our investor education website www.investucatett.com such as: a risk profile test, Investor Education Manual and Work Book and Online course, blog articles, life stages and our Investing Game, Investor Quest tt – www.investorquest-tt.com. We also discussed some of the key considerations prior to making an investment, such as your risk appetite, your investor profile, setting financial goals, and knowing the types of registered investments available in our local capital market.

For the final post in this three-part investor education series, we share some tips on how to select a stockbroker and how you can protect yourself from investment fraud or scams.

Before making a securities investment, you must decide which brokerage firm – also referred to as a broker-dealer, a stockbroker, sales representative or account executive – to use.

1. Before making these decisions, you should: Think through your financial goals and objectives as well as ensure that the investment that you choose meets your financial goals and is aligned to your investor risk profile.

2. Meet and talk with potential broker-dealers at several firms, you can consider this similar to ‘shopping around’. Meet them face to face and ask each representative about his/ her investment experience, professional background, and education.

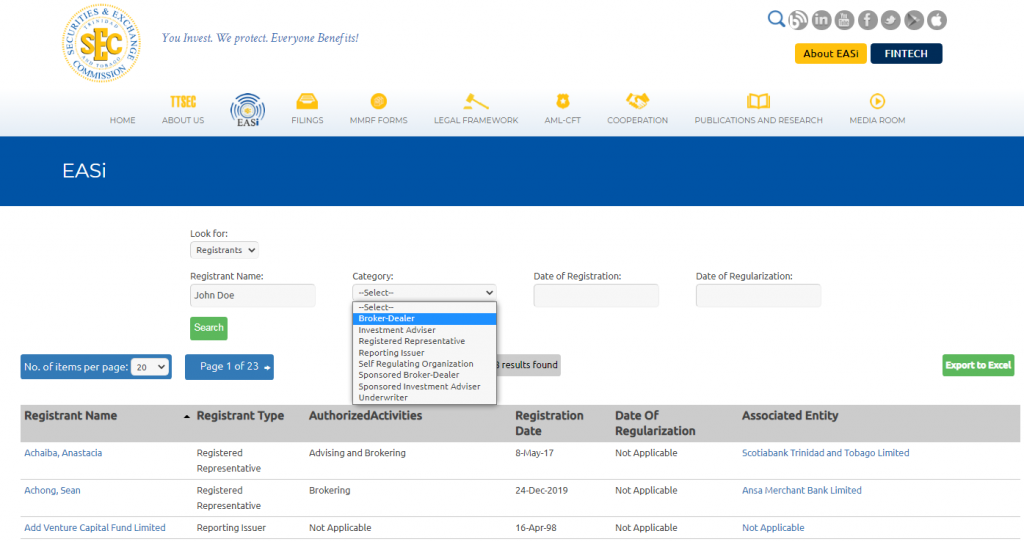

3. Do your research. Find out if the representative and the Firm are registered with the Trinidad and Tobago Securities and Exchange Commission (TTSEC). Visit the TTSEC’s corporate website, www.ttsec.org.tt for a full list of registrants with the Commission. Understand how the broker-dealer is paid and in particular their fees. Firms generally pay sales staff based on the amount of money invested by a customer and the number of executed transactions. Ask what “fees” or “charges” you will be required to pay when opening, maintaining and closing a brokerage account.

4. Determine the level of service you need. Some brokerage firms provide recommendations, investment advice and research support, while others may not. The charges you pay may differ depending on what type of services are provided by the firm.

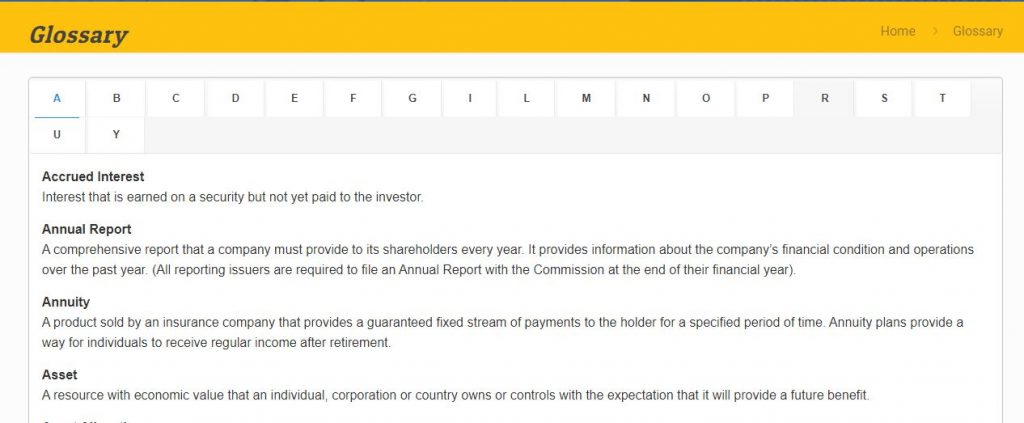

5. Never invest in a product that you don’t fully understand. Consult credible information sources such as business and financial publications. Information regarding the fundamentals of investing and basic financial terminology via our online glossary which can be found on our Investor Education Website.

6. Ask your broker-dealer for the prospectus, offering circular or most recent annual report and ensure that you read and understand them before making any investment decision.

Prospectus

If you have questions about the contents of a prospectus talk with your representative to understand the details outlined therein. Remember, you have the right to information so do not be afraid to ask questions. You also may want to check with another brokerage firm, an accountant or a trusted business adviser to get a second opinion about a particular investment you are considering.

Keep a record of all information you receive, copies of forms you sign and conversations you have with the broker-dealer.

Protect Yourself

Part of making the right investment decision is finding the brokerage firm and the sales representative that best meets your personal financial needs. Do not rush into any investment decision. Resist salespeople who urge you to immediately open an account with them. A high-pressured sales pitch can sometimes mean trouble. Be suspicious of anyone who tells you, “Invest now or you will miss out on a once in a lifetime opportunity” or uses the words “guaranteed return”, as all investments have some form of risk.

Remember:

- Never send money to purchase an investment based simply on a telephone sales pitch, newspaper or online ad.

- Never make a cheque out to a sales representative personally. Investment advisers are not allowed to receive money directly from clients or invest on their behalf.

- Never send cheques to an address which is different from the business address of the brokerage firm or a designated address listed in the prospectus.

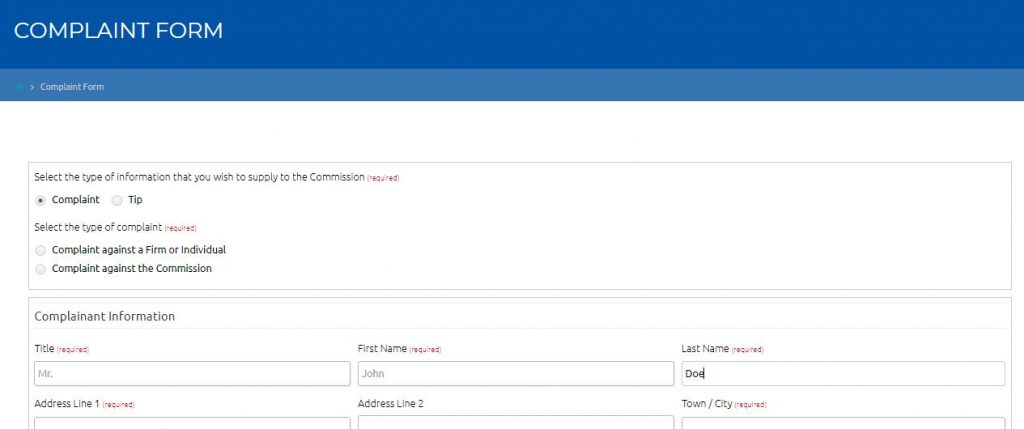

- If your sales representative asks you to do any of these things, contact the branch manager of the brokerage firm and the TTSEC to lodge a formal complaint.

- Never allow your transaction confirmations and account statements to be delivered or mailed to your sales representative as a substitute for receiving them yourself. These documents are your official record of the date, time, amount and price of each security purchased or sold. When you receive them, you should verify that the information in these statements is accurate.

This post is intended solely to provide you with the information and resources you may need to help guide you in making sound investment decisions and to ensure that you are familiar with and understand, your rights and responsibilities as a consumer of financial services.

If you conclude that your rights as investor have been infringed you can lodge a complaint. To submit a complaint, ensure that you complete the prescribed complaint form located on the TTSEC website, https://www.ttsec.org.tt/about-us/investor-complaints/.

To learn more, visit the TTSEC website at www.ttsec.org.tt to view the full list of registered investment advisors, broker dealers and investment products. Before you invest, educate and empower yourself to make wise financial decisions.

You Invest. We Protect. Everyone Benefits.

For more information and regular updates and investor education tips connect with us via any of our social media handles: