[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Investing 101 in Trinidad and Tobago [/heading]

- Are you worried about your future and whether you will have enough money to live comfortably during your retirement years?

- Have you ever thought about increasing your wealth and investing in the local securities market?

- Are you interested in investing, but don’t know how or where to start? Without the necessary knowledge and understanding, you could possibly jeopardise the security of your financial future.

The Trinidad and Tobago Securities and Exchange Commission (TTSEC) as the regulator of the securities industry in Trinidad and Tobago, is mandated to protect investors and encourage the growth and development of the industry.

To achieve this the TTSEC provides a wide range of online resources for individuals seeking to venture into the world of investing. In the next few weeks, we will share with you the different avenues available from the TTSEC for educating yourself on investing.

Investor Education is a broad area of focus, so much so that the TTSEC has a dedicated website solely for the promotion of education on investment. This is your go-to online portal, for all the information that you may need to get started with investing as well as other useful blogs and materials available right here.

In this Blog post we discuss investing in the Trinidad and Tobago securities market and will guide you through some investing basics and share a few key features of this website along the way.

Investing is usually considered a good way to make your money grow and create future wealth. However, before you begin to invest your hard-earned money, you must consider a few things such as your objectives for investing and the level of risk that you are prepared to take.

Ask yourself these questions:

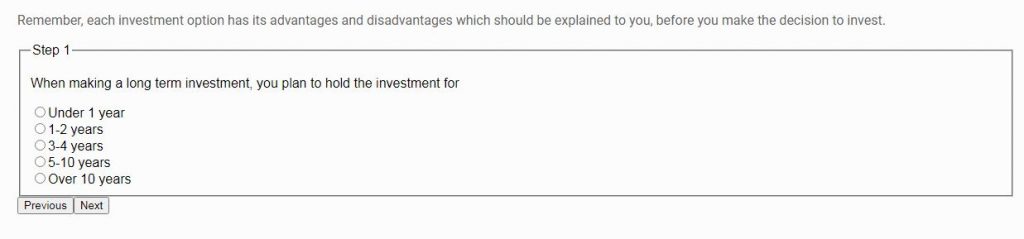

What are my future financial goals? Given my current financial standing, how much risk am I willing to take? Remember, higher risk means that you may lose some or all of your money so it is important to ask yourself, Do I want to take the chance to make more money if it also means that I may lose money? or Would I rather make less and invest in a safer instrument? To assist in determining your risk appetite the TTSEC has a risk profile test that we recommend you take prior to investing and/or consulting with a registered investment adviser. Visit https://investucatett.com/investment-tools/ to take the risk profile test.

Risk Profile test:

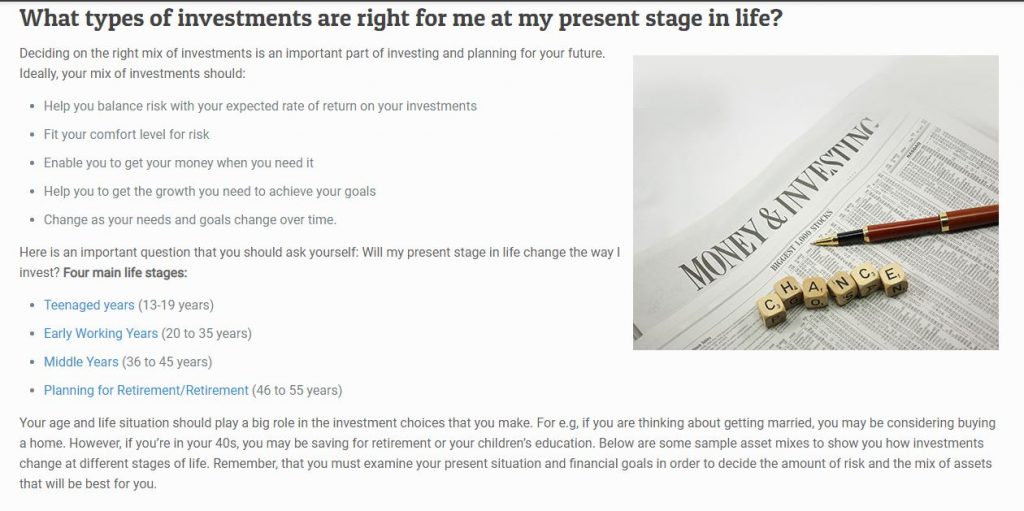

Furthermore, depending on your stage in life, you may be more willing, or able, to take more risk than others as you may have more years to bounce back in the event of a loss. There is also a guide available which will help you decide on the type of investment that may be right for you during your particular life stage https://investucatett.com/life-stages/

Life Stages- Guide:

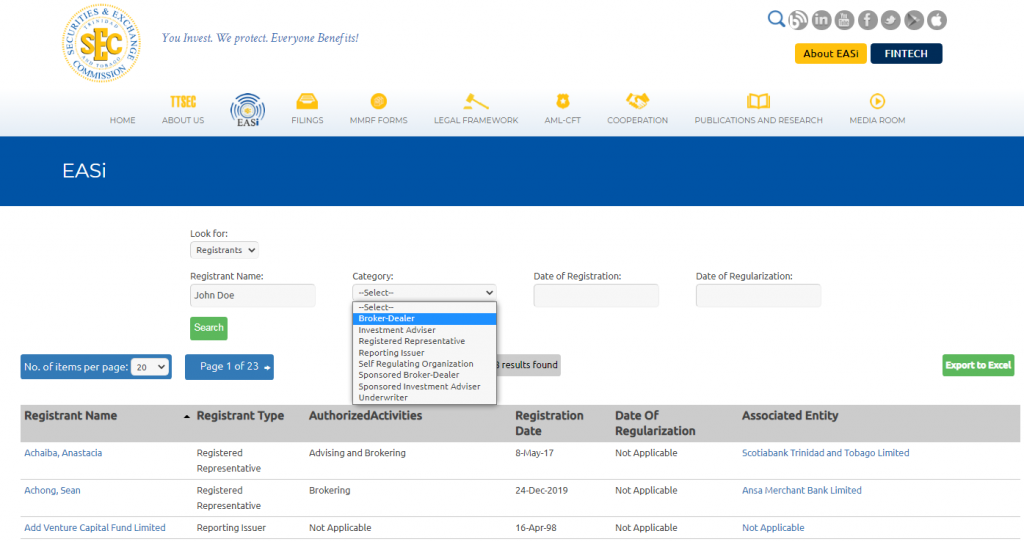

As part of your preparation for investing you should always conduct your own research and have a detailed plan indicating exactly what you wish to achieve and the time within which you hope to achieve your financial goals. Also consider the various types of investment products that are available and then consult with a registered investment adviser. Visit www.ttsec.org.tt/registration to search for a list of registered Investment Advisers.

Check Registration Database:

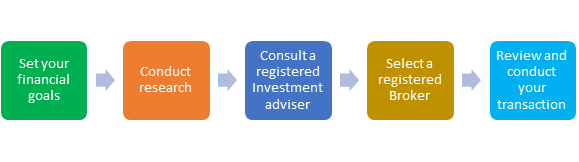

The diagram below illustrates the process that you should follow.

During this process you may start contemplating the following:

‘How much am I hoping to make by investing in a particular product?’ This question refers directly to the return on ones’ investment, which can sometimes take the form of income (interest or dividends) or capital gains or capital losses (the increases or decreases in the price of a share).

How long do I plan to invest? An investor’s investment horizon, that is, the total length of time that the investor expects to hold a security or portfolio, is primarily determined by the investor’s investment goals, including income needs and risk tolerance. For example., saving for a car is a short-term goal whereas allocating money for retirement is a longer-term goal. Once these goals are clearly defined, the appropriate investments can be selected to best achieve those targets.

How easy will it be to get back my money from an investment? Cash is normally considered the most liquid asset since it is normally kept in small quantities on hand, while larger sums are kept in a regular bank account or credit union. The amount which is placed in a bank account can usually be retrieved from the teller or via an ATM. In most cases, when you give up the opportunity to easily access your money, you have the potential to earn higher returns, as with many investments. However, it must be noted that many investment options, which promise a fixed rate of return, usually limit the accessibility of your money for a specified time frame.

In 2018 the TTSEC developed an Investor Education Manual and Workbook primarily for students to increase their knowledge and understanding of the securities market and investing.

|

|

This was then utilised to develop a free Investor Education online course – https://investucatett.com/online-course-introduction/ where anyone who is interested in increasing their investment knowledge, have the opportunity to participate in nine (9) units of lessons and activities. Once completed, persons also have the opportunity to take a quiz and obtain a digital certificate of completion from the TTSEC.

Remember every individual’s situation is different and each investor will differ from another. What is important to note however, is that investing is not the same for everyone. It depends on your individual financial goals, risk tolerance and available income or savings. Before investing or purchasing any investment product, you should consult with a registered investment adviser, broker or professional.

You Invest. We Protect. Everyone Benefits.

For more information and regular updates and investor education tips connect with us via any of our social media handles: