[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Learning Objectives [/heading]

-

Describe types of Investor Scams

-

Understand the dos and don’ts of investing

-

Explain how to identify a fraudster/ scam

-

Identify the rights and responsibilities of an investor

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Introduction [/heading]

A major role of the TTSEC is to protect investors. It does this by educating the public about their rights and responsibilities as investors and informing them about investment fraud. The TTSEC also takes enforcement action against persons who breach our legislation or guidelines. This Unit highlights some of the ways in which persons can identify a fraudster and what they should do if they or their families encounter such a person or scam.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Financial Fraud and Investor Scams [/heading]

Anyone can fall victim to financial fraud. Here are some scams to be wary of:

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Internet Scams [/heading]

Con artists reach millions of victims via the internet. They lie to try and convince you to either send them money or your personal bank card or financial information. With the Internet, fraudsters can operate anonymously from anywhere in the world, making them hard to catch. Once you’ve given your money to an online scam artist, it’s likely gone for good. Double check any information or suspicious emails you receive.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Boiler Room Scams [/heading]

With this scam you can expect to receive a phone call from someone you don’t know, claiming to offer you the “chance of a lifetime” to make lots of money. Saying it’s a “sure thing” as long as you keep buying a certain stock. They attempt to persuade you to invest in shares that are either non-existent, or so worthless they are impossible to sell. The fraudsters may provide false share certificates and other documents to make the investments seem credible. Once the fraudsters have squeezed whatever money they can from investors, they quickly disappear.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Ponzi or Pyramid Schemes [/heading]

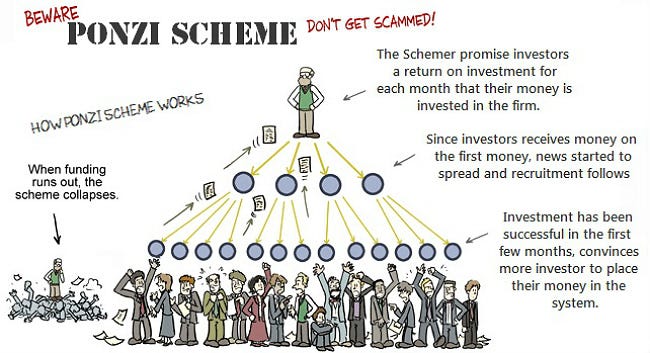

With Ponzi Schemes the premise is simple: pay early investors with money raised from later investors. The only people sure to make money are the promoters who set the Ponzi in motion. In this scam high returns are promised to investors. Ponzi schemes are sometimes referred to as pyramid schemes, but this is inaccurate.

In pyramid schemes the promoter starts off like a Ponzi scheme but the difference is that the promoter encourages investors to bring in new investors thus, adding succeedingly broader levels giving the scheme a triangular or pyramid shape. The promoter in this instance, relies on the next layer of victims to invest their monies, to support the previous layers of investors.

Inevitably new people stop joining and since it is the funds from the new persons that keep the pyramid steady, the pyramid eventually begins to totter and there is no more money to be paid out. You and countless others subsequently lose your investment.

Image Source: Decentralize.Today

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Unlicensed Selling of Securities [/heading]

Anyone selling securities without a valid securities license should be a red alert for investors.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Unregistered Investment Products [/heading]

Con artists bypass stringent registration requirements to pitch settlements, and other investment contracts with the promise of “limited or no risk” and high returns.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Promissory Notes [/heading]

A promissory note is an unconditional promise in writing made by one person to another signed by the maker, agreeing to pay, on demand or at a fixed or determinable future time, a certain sum of money to, or to the order of, a specified person or to bearer.* Basically it is a signed document containing a written promise to pay a stated sum to a specified person or the bearer at a specified date or on demand. “Empty promises …. printed.”

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Senior Investment Fraud [/heading]

Seniors are particularly vulnerable to scam artists who pretend to be “nice” or attempt to develop a false bond of friendship. Scam artists prey on seniors who are polite to others and have difficulty saying “no” or feel indebted to someone who has provided unsolicited investment advice. These financial predators use tactics to instil seniors with the fear of running out of money and becoming a burden to their families. They prey upon the loneliness and isolation, and availability of some retired or widowed seniors. Seniors should carefully check the credentials of investment advisers or financial planners holding themselves out to be “senior specialists.”

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Affinity Fraud [/heading]

This scam often happens in social groups. Con artists are increasingly targeting religious, ethnic, cultural and professional groups. They quietly join a club, religious or community group. Once they gain the trust of the members in the group, they will try to convince them that their fraudulent investment is legitimate, and encourage them to participate. These con artists sell to a few prominent members of the community and then pitch the scam to the rest of the group by using the names of those previously sold. They will then eventually scam the group members, their friends and families, and just as quietly, disappear.

This scam often goes unreported – victims include: minority groups, religious groups, the elderly etc.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Activity 1: Investment Fraud Key Words[/heading]

Download: Activity 1 to match the investment fraud key words.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Red Flags of Fraud [/heading]

Warning signs of investment fraud:

- Guarantees: “This investment is guaranteed” – Be suspicious of anyone who guarantees that an investment will perform in a certain way. All investments carry some degree of risk and performance cannot be guaranteed.

- Unregistered products: Many investment scams involve unlicensed individuals selling unregistered securities—ranging from stocks, bonds, notes, hedge funds, or fictitious instruments.

- Overly consistent returns: Even the most stable investments can experience hiccups once in a while.

- Missing documentation: If someone tries to sell you a security with no documentation—that is, no prospectus in the case of a stock or mutual fund, and no offering circular in the case of a bond—he or she may be selling unregistered securities. The same is true of stocks without stock symbols.

- A pushy salesperson: No reputable investment professional should push you to make an immediate decision about an investment, or tell you that you’ve got to “act now.” If someone pressures you to decide on a stock sale or purchase, simply walk away. Even if no fraud is taking place, this type of pressuring is inappropriate.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Common things a fraudster may tell you [/heading]

Here are some common things a fraudster may tell you:

- “I am offering you double the returns that you can’t get anywhere else.”

- “This deal is going fast and will not be around for long. You must act soon!”

- “Just make the cheque out to me. It’s a lot easier that way.”

- “You know not many people know about this deal” Now is the time to take advantage of this opportunity and make money.”

- “Other smart people like you have already joined and are making a fortune.”

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]How to Protect Against Ponzi Schemes [/heading]

Beware of promises of unrealistic returns. This is perhaps the easiest way to spot a Ponzi scam. Any legitimate investment involves risk. Guarantees of unrealistically high returns are a clear warning sign. If you think that this offer is, “Too good to be true,” then this should be considered a red flag.

Diversify everything. Don’t put all of your eggs in one basket. Diversify not only your assets but also your money managers, accounts, and financial institutions. Spreading your money around will limit your exposure to the financial problems of any one institution.

Don’t rely on reputation or word of mouth alone – understand your investment. Con artists are experts at building networks of trust, making investors think they are getting an “inside” track on a hot investment. If someone gives you an “inside” tip, (which may refer to material non-public information about an investment product) don’t just hand over your money. Remember that you too can be found guilty of insider trading which can result in high penalties. According to the Securities Act 2012, section 102 – A person who engages in insider trading activities, as described in the Securities Act 2012, commits an offence and is liable on summary conviction to a fine of ten million dollars and imprisonment for ten years.

Verify the investment details. Ask comprehensive questions about the investments and those selling the investments, and get clear and direct answers before you invest. If you don’t understand an investment, don’t invest right away. Do your research first and ensure that you are confident and comfortable investing in the product.

Background Check. Check with the TTSEC to determine if the individuals and firms selling the investment are properly registered. Remember, anyone selling a security must be registered with the TTSEC. If the promoter says he’s exempt, follow-up with your regulator to confirm the claim. Report fraud. If you’re a victim of a Ponzi scheme, call the Trinidad and Tobago Securities and Exchange Commission. As the securities regulator for Trinidad and Tobago, the TTSEC can investigate the matter and your call may help prevent others from becoming victims of the same scam.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Rights and Responsibilities of an Investor [/heading]

- You have a right to receive truthful information from an investment adviser

- You have a right to accurate information from a Reporting Issuer (A company that has issued shares to the public and is subject to continuous disclosure requirements by the Securities and Exchange Commission)

- You have a responsibility to ask questions and do your research on the investment adviser, the broker dealer and the investment product

- You have a responsibility to check with the TTSEC’s website – www.ttsec.org.tt for a list of registered companies, investment advisers and broker-dealers before conducting any investment transactions

- You have a right to choose where you wish to invest. Explore all your options

- You are entitled to lodge a complaint with the TTSEC if you experience any problems

Before making any securities investment, all investors are urged to ask the following questions:

- Is the seller licensed and the investment registered?

- Has the seller provided you written information that fully explains the investment?

- Are claims made for the investment realistic?

- Does the investment meet your personal investment goals?

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Research your investments [/heading]

The best way to protect your money is to be an informed investor. Before you buy any investment product, find out as much as you can about it. Read financial documents like the prospectus and financial statements. Public companies and investment funds are required by law to file these and other documents.

You can also get information from:

- Analysts’ reports

- Financial newspapers and websites

- Investment newsletters

These sources provide very useful information, but remember each source only forms part of the overall picture of a company. Be sceptical of what you read and check as many different sources as you can, to get a more complete picture. You can also get a second opinion from an independent financial advisor.

Don’t let this be you! Don’t be a victim of investment fraud.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Activity Sheets for Download[/heading]

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Congratulations! [/heading]

You’ve just completed Units 1 to 9 of our Investor Education Course!

Are you ready to complete your financial education journey?

Click the blue button below to evaluate what you have learnt and to receive your personalised investor education course certificate!