[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Learning Objectives [/heading]

-

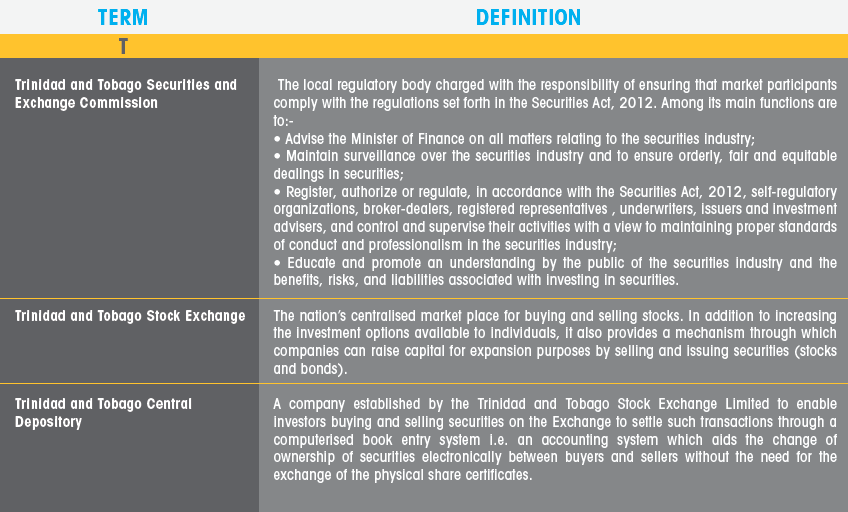

To explain key words and terms in the securities industry

-

To debunk myths about investing

-

To differentiate between budgeting and financial planning

-

To develop a simple personal income statement

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Introduction [/heading]

In an effort to better understand key concepts in investing, you should be able to recognise and understand key words and terms within the securities industry. This Unit also couples a basic understanding of budgeting and financial planning, to help prepare you for the next Unit on building an investment portfolio.

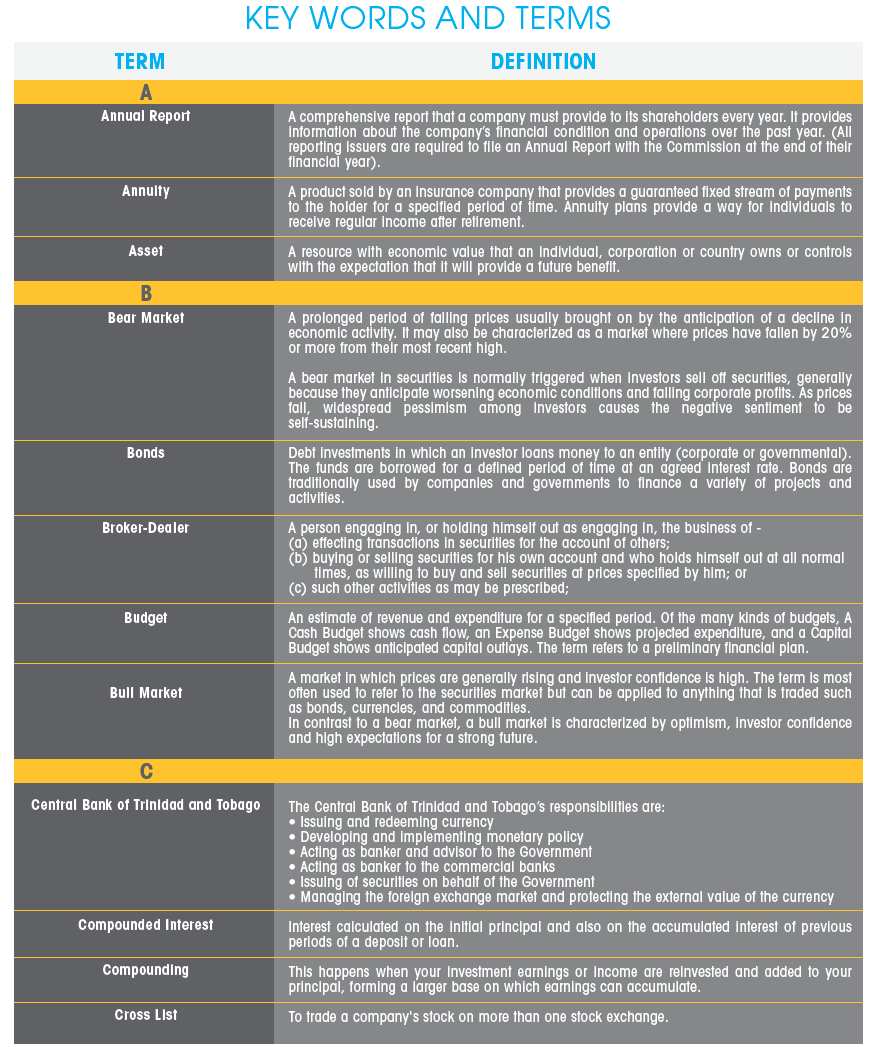

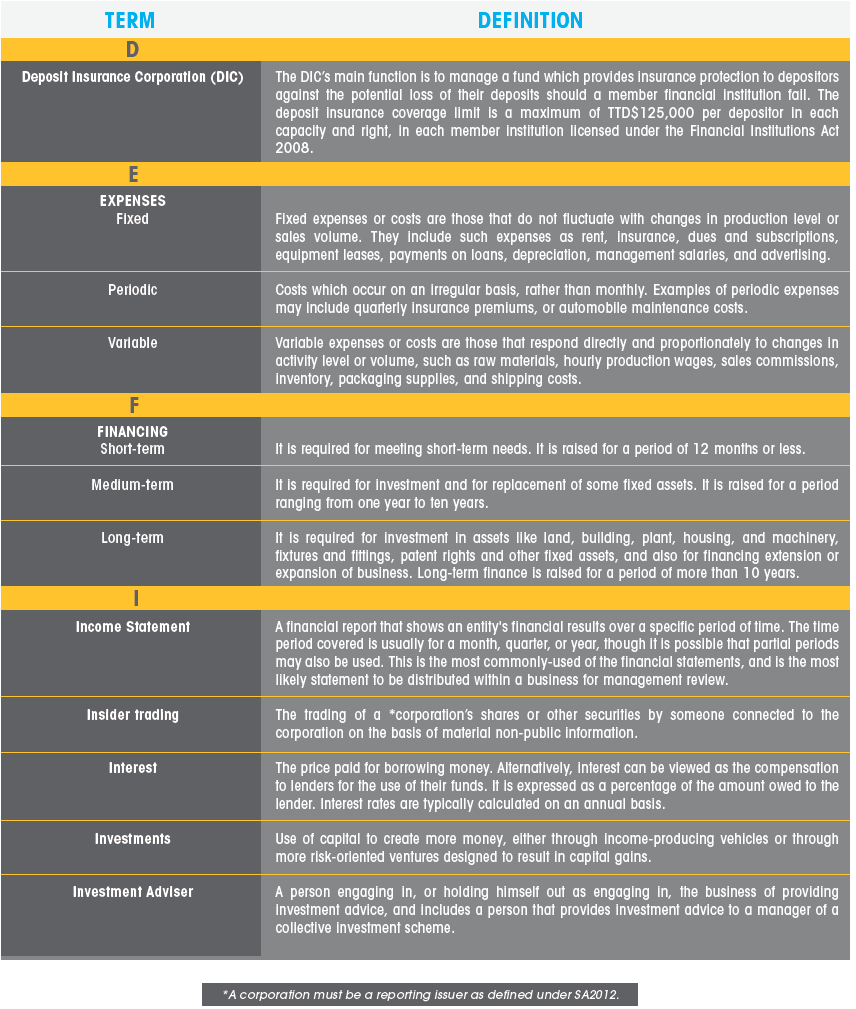

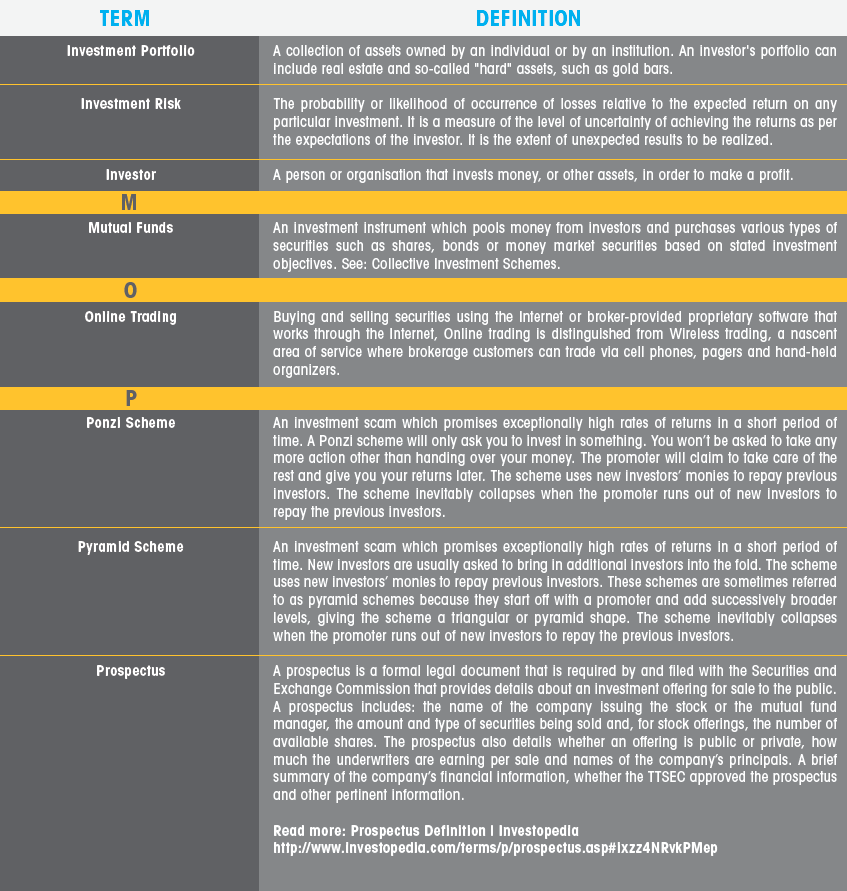

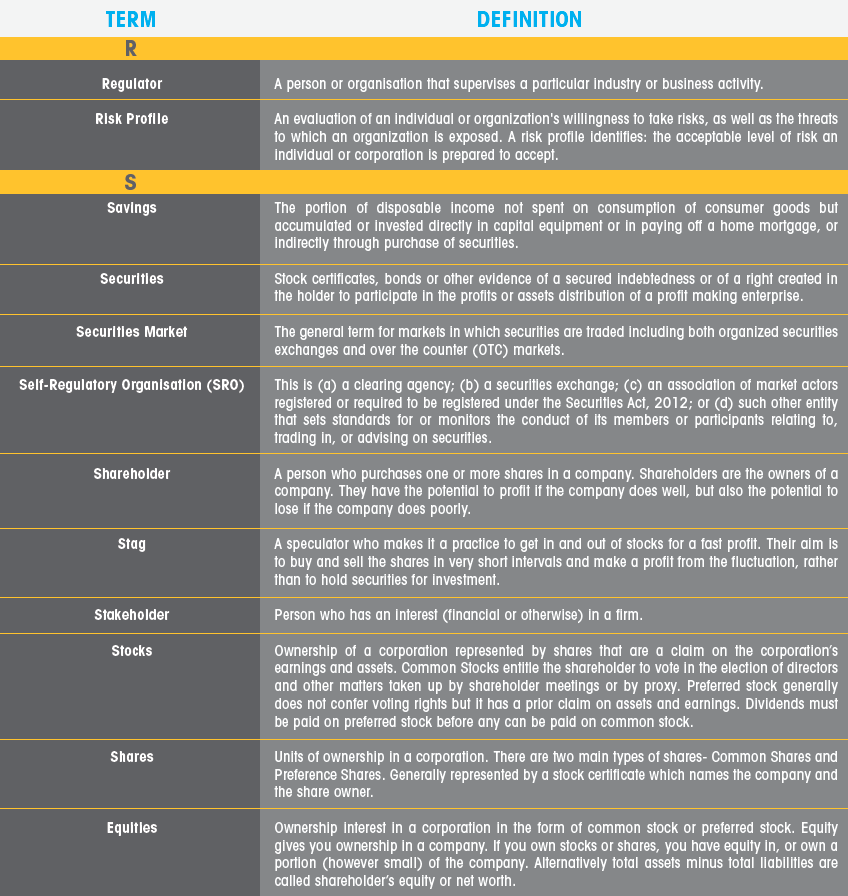

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Key Words and Terms [/heading]

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Online Glossary [/heading]

You can also check out our Online Glossary for a more comprehensive list: https://investucatett.com/glossary-3/

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Activity 1: Key Word Search[/heading]

Download: Activity Sheet 7.1: Key Word Search

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Debunking Myths about Investing [/heading]

Myth #1 – You Need a Lot of Money to Invest

A modest amount of cash set aside at regular intervals can result in a big nest egg upon retirement. Consider that even a person making $30,000 a year and setting aside 5% of their income over 30 years will end up with more than $150,000, based on a 7% annual return.

Myth #2 – It’s Overly Risky

Investing is not without risk, but you are fully in control of how much risk you want to take. If you’re a risk averse (not willing to take risk) type, there are many investments, such as bonds and mutual funds, that will allow you to make money without much risk. And it’s important to remember that while stocks can go down in value quickly, they have historically always rebounded.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Financial Planning [/heading]

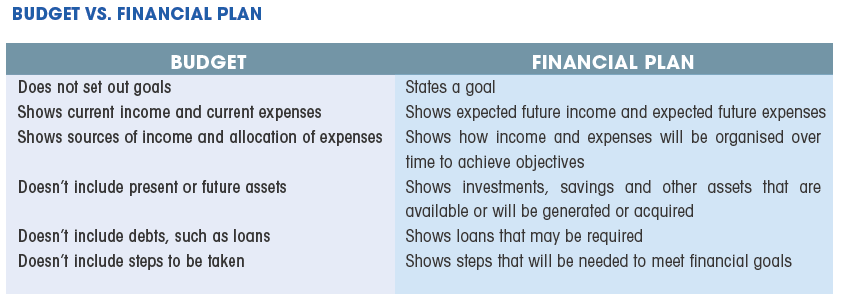

- What is a financial Plan?

- What is a budget?

- Is there a difference between the two?

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Budget vs. Financial Plan [/heading]

- A budget compares income with expenses and shows whether you have a surplus or a deficit.

- A budget is useful for managing your money over the short term.

- A financial plan is a road map to help you manage your finances over the longer term to reach your financial goal.

“Why do you need a financial plan?” or “How can a financial plan help you?”

– To achieve a financial goal – for example – pursue your education, a car, a house.

– Minimise your taxes

– Cover insurance needs

– Buy a home and pay off the mortgage quickly

– Fund your children’s education

– Optimise employee benefits and pensions

– Save and plan for retirement

– Fund long-term health issues

– Care for elderly parents

– Manage estate planning and how to transfer wealth in families.

Big idea – Remember that a financial plan is a living document. You need to revisit it and update it regularly as your circumstances change.

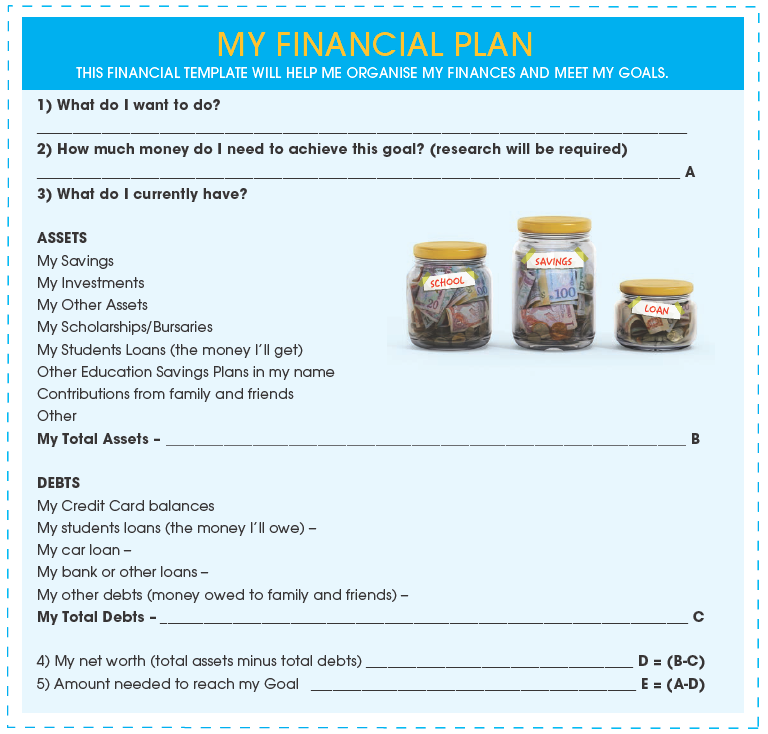

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Activity 2: My Financial Plan[/heading]

Download Activity 2: to map out your financial plan!

Consult a financial planner or investment adviser

- For complex financial planning, you should consult a qualified financial planner or investment adviser.

- Some financial planners can help you with long-term financial planning as well as with investment advice.

- To find a registered investment adviser – visit ttsec.org.tt

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Activity Sheets for Download[/heading]