[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Learning Objectives [/heading]

-

To reinforce the securities industry as part of the financial landscape in T&T

-

To highlight the key players in the Securities Industry

-

To explain the role of the regulator – TTSEC; role of the TTSE and the Central Bank

-

To describe the different types of investment instruments

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]The Financial Landscape in Trinidad and Tobago [/heading]

Who or what ‘makes up’ the financial landscape in T&T?

The Securities Industry is often overlooked as part of the financial landscape of Trinidad and Tobago. Generally the Central Bank of Trinidad and Tobago (CBTT) regulates or has direct supervision over the following financial institutions: Commercial Banks; Insurance Companies and Credit Unions; Pensions Sector, the Exchange Bureau (bureaux de change) and the Home Mortgage Bank. The Central Bank Act is the primary legislation governing the CBTT. The Financial Institutions Act is also a critical piece of legislation for the CBTT.

The Trinidad and Tobago Securities and Exchange Commission (TTSEC) regulates the Securities Industry. Securities are considered investment instruments. These include: stocks (shares), bonds and mutual funds — which are legally considered to be securities within Trinidad and Tobago. Securities tend to be widely available, easily bought and sold, and subject to regulation by the TTSEC.

However, investing in securities carries certain risks as mentioned before. That’s because the value of your investment changes as the market price of the security changes in response to investor demand. As a result, you can make money, but you can also lose some or all of your original investment.

The Securities Act (2012) is the primary legislation governing the operations of the TTSEC.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]TTSEC’s Mandate [/heading]

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Institutional Framework [/heading]

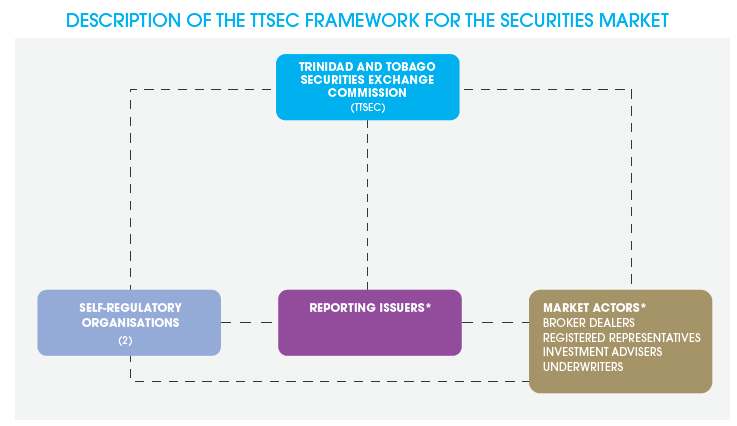

Here’s a framework identifying the key regulators in our financial industry. The regulators are all independent but have relationships which support each other.

The TTSEC also has direct oversight of the market players in the diagram above. Market players include: Self-Regulatory Organisations – as mentioned before:

- Trinidad and Tobago Stock Exchange Limited (TTSE)

- Trinidad and Tobago Central Depository Limited – A subsidiary of TTSE, which provides an efficient, safe and prompt clearing and settlement of securities transactions for participants by employing an automated data processing book entry system to track and monitor securities transactions in the market.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]T&T Stock Exchange Limited[/heading]

The T&T Stock Exchange (TTSE) facilitates the fair trading of a company’s ownership among potential investors. It allows companies to raise funds/money by providing them with access to a pool of private and institutional investors. An exchange’s role in financial markets is pivotal for the development of the financial industry. The TTSEC regulates the TTSE and also seeks to ensure fair and transparent transactions are conducted to protect investors.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Securities Dealers Association of T&T [/heading]

SDATT – Securities Dealers Association of Trinidad and Tobago

SDATT is a non-profit organisation that collaborates with governance bodies in the local Securities Industry to assist in the advancement of this Industry by supporting the development of legislation. SDATT’s mandate is to be a resource for the investing public through the provision of unbiased information and analysis.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Mutual Fund Association of T&T [/heading]

MFATT – Mutual Fund Association of Trinidad and Tobago

MFATT is a non-profit company, which is the representative body of mutual fund practitioners, spearheading the development and growth of the mutual fund industry in Trinidad and Tobago and the Caribbean. Its membership comprises the largest operators of mutual funds in Trinidad and Tobago.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Market Actors[/heading]

Market Actors

– Broker-Dealers

– Registered Representatives

– Investment Advisers

– Underwriters

– Reporting Issuers

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Video: Key Players in the Securities Industry[/heading]

These players are all regulated by the TTSEC. Regulation ensures that these entities conduct fair and transparent transactions, and provide regular and accurate reporting to the Commission. The TTSEC thus ensures a safe and easily accessible market for all investors and potential investors.

The diagram below shows the relationship between the market players.