[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Learning Objectives [/heading]

-

Identify reasons for saving and also prioritizing those reasons

-

Identify saving goals

-

Differentiate between saving and investing

This Unit introduces you to the concepts of saving and investing. It includes linking financial goal-setting to saving and investing, understanding the need to save and ways in which persons can secure their financial future.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Reasons for Saving[/heading]

SELF QUESTIONS

- Do you save money?

- Do you save regularly?

- What do you save money for?

- Why do you save?

Why do we save for the future?

- Feel more secure and in control

- Be prepared for emergencies

- Reduce stress and conflict

- Spend with less guilt or fear

- Afford major purchases

- Pay off debt and avoid new debt

- Retire comfortably

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Creating Savings Goals [/heading]

Without specific saving goals, people are usually not motivated to save.

Here are some helpful tips for creating saving goals:

- Make your goals specific

- Set a dollar amount and a deadline

- Break up your long-term goal into smaller more manageable goals

- Write down your goals and post them where you can see them every day

Some examples of savings goals:

- Save some money for a rainy day. – This is a vague, not very useful goal

- Build an emergency fund of $2,000 by saving at least $1,000 by the end of the year- This is a specific, and achievable goal

- Set smaller goals towards a bigger goal: Save $200 a month, or $100 every two weeks, rather than saving $2,400 in a year.

Write down your goals and ensure that they are SMART Goals.

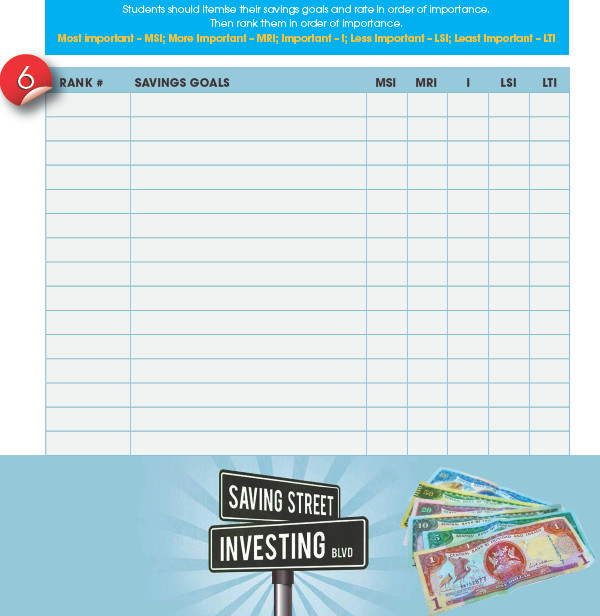

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Activity: Prioritising Your Savings[/heading]

Itemise your saving goals and then rate them in order of importance.

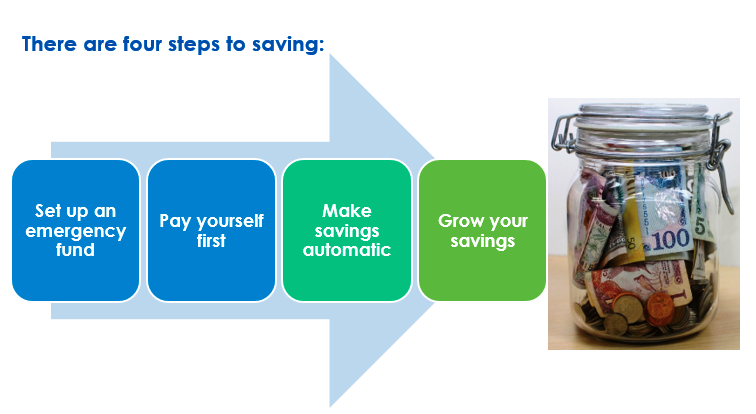

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Four Steps to Saving[/heading]

Set up an emergency fund

- First, set up an emergency fund

- Save 3 to 6 months’ worth of take-home pay

- This is what you’ll rely on if you lose your job, get sick or have unexpected expenses

- Keep the money in a separate savings account or in an easily cashable investment

- Don’t rely on credit cards, bank loans or personal lines of credit (borrowing) for an emergency, and

- Don’t spend your emergency fund on non – emergency expenses

- Have you ever heard the phrase “Pay yourself first”?; It means to set aside your savings before you spend on other things.

- Treat savings like any other recurring bill that you must pay each month

Make savings automatic

- Automate the deduction of a set amount of money from every pay cheque

- Ideally you should be saving 5% -10% of your salary/income

- For example, if you earn $2,000 a month after tax: Saving 5% = $100 a month = $1,200 a year

- Saving 10 % = $200 a month = $2,400 a year

- Set up direct debits from your bank account

- Individuals below the age of 16 can ask their parents to help them set up an account and make monthly deposits, or take you to the bank to do your own transactions.

Protip – Any extra money that children and teenagers receive – from an allowance, grandparents or relatives, as gifts, or money received from doing chores, etc. can all be saved in their account.

There are times when we all receive savings, either by claiming on our taxes, bonuses at work, gifts, or a windfall, you too can add to your savings pool accordingly, or add towards your financial goals.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Video: Three ways to save money[/heading]

What are your top 3 money-saving tips?

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Growing your Savings[/heading]

Grow Your Savings – Concept of Investing

Do you know what is investing? Or What it means to invest?

Investing means putting your money to work for you. It’s a different way of thinking about making money. The key to investing is saving. Once you get into the savings habit and you’ve got a pool of money set aside, you need to put your money to work to grow your savings. This is what we call investing.

There are many different ways in which you can go about making an investment. This includes putting money (or your savings) into stocks, bonds, mutual funds, real estate, or starting your own business. Sometimes people refer to these options as “investment vehicles”. These investment vehicles will be discussed later on in the other Units of this course.

It does not matter which method you choose for investing your money, the goal is always to put your money to work so that it earns you an additional profit.

Key Points

- Save for emergencies

- Pay yourself first

- Make your savings automatic

- Saving in order to invest

ProTip: Anyone seeking to invest in securities, must conduct their own research and get advice from reliable sources. You should consult with a registered Investment Adviser before engaging in any investment decision.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Activity Sheets for Download[/heading]