[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Learning Objectives [/heading]

-

Distinguish between wants and needs

-

Explain the decision making process

-

Explain the concept of prioritizing

This Unit provides you with the ability to recognise and understand the difference between personal needs and wants, helps you set priorities and make sound financial decisions required for saving, budgeting and financial planning.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Needs vs. Wants[/heading]

An important component of financial planning is determining and differentiating between your wants and your needs.

An individual’s needs are those items necessary for survival. These may comprise – water, food, clothing, shelter, medical care.

An individual’s wants are those things not required for survival, but which are desired for improved comfort and satisfaction. Wants vary according to each individual’s tastes, likes and lifestyles. Wants are considered non-essential items such as: types of sneakers, handbags, dresses, electronic items, etc.

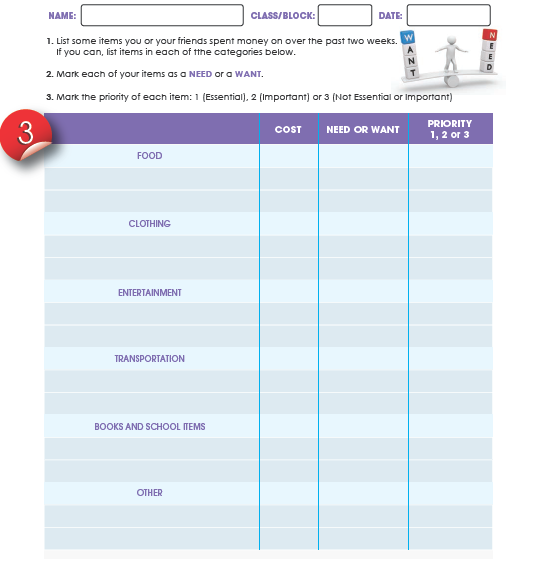

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Activity: Needs, Wants and Priorities [/heading]

Individuals experience needs and wants differently based on values, culture, background, age etc. Understanding which of your needs are important or which take priority, will help to initiate the development of an effective budget. Of note, values change over time because of our life experiences. Values in turn influence our needs and wants and ultimately our goals. Our values are related to financial planning. For example, if your parents value your education, they focus on investing in your education. Therefore, they may have been more inclined or motivated to save for your schooling expenses. Similarly, if you value a comfortable retirement you will value saving for your retirement.

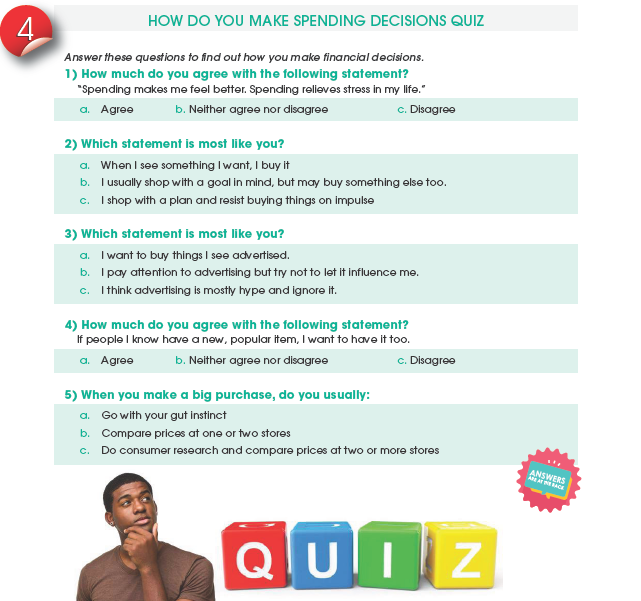

Take this Quiz to better understand your spending habits and thought processing.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Activity: Spending Decisions Quiz[/heading]

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Activity: Think Tank[/heading]

Scenarios – Think Tank

Read the following two scenarios. What advice would you give them?

Life Example 1 – Leo is an 18-year-old boy whose goal is to be an accountant. He does well in school, but his family doesn’t have a lot of money and wants him to help cover the household expenses by getting a job. He is very focused and willing to make sacrifices to achieve his goal.

What should he do?

Life Example 2 – Mandy is a 16-year-old girl who is saving money so that she can study to be a nurse. One day she finds out her uncle has passed away, and her father asks her to help pay for the funeral. Mandy always wanted to become a nurse, but she loves her family and wants to support them as well. What should she do?

There is no right or wrong answer. The exercise encourages you to think about life, its challenges and the need to refocus your goals to meet the reality of what life offers each day.

Whether that means:

- Adjusting the time to achieve your goal,

- Doing something differently,

- Setting priorities,

- Giving up something, etc.

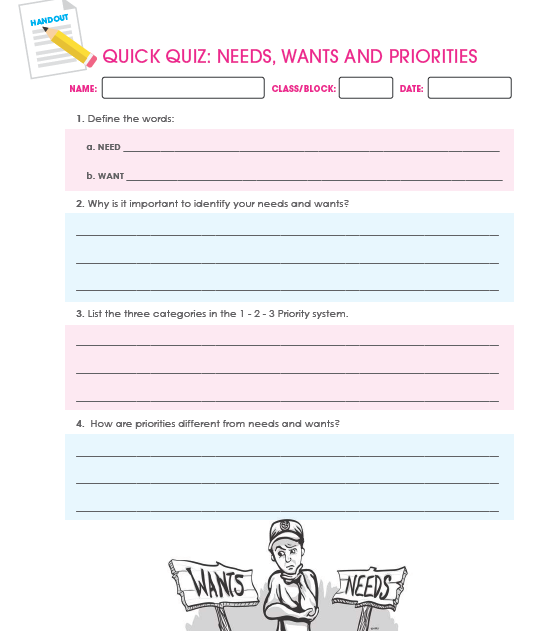

Take the quick quiz below to see if you really understand this topic.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Opportunity Cost[/heading]

Let’s take it a Step Further

Opportunity Cost

The concept of “Opportunity Cost” can be applied to financial planning and investing.

Opportunity Cost –Refers to a benefit that a person could have received but gave up, to take another course of action. Simply put, it is the thing you are willing to give up so that you can accomplish something else. When you look at your options in this way, and put a cost to your decisions, you may be able to prioritise better. It may be a goal, a need or a want.

The benefit or value that was given up can refer to decisions in your personal life, in a company, in the economy, in the environment, or on a governmental level. Refer to the previous examples and see what the opportunity costs are in those examples.

Example 1: The ‘Opportunity Cost’ of going to University right after school, would be the money/opportunities you would have lost out on if you started working earlier. The benefit to studying is the hope or expectation that you will earn a higher salary once you have your certification.

Example 2: The ‘Opportunity Cost’ of foregoing a movie to stay home and study for a test in order to get a good grade, would be the cost of the movie and the enjoyment of seeing it. The benefit would be a good grade based on the extra studies put in.

In both cases above, a choice between two options must be made. It would be an easy decision if you knew the end outcome; however, the risk that you could achieve greater “benefits” (be they monetary or otherwise) with another option is the opportunity cost.

Can you identify the opportunity costs in your life or in some other real life examples?

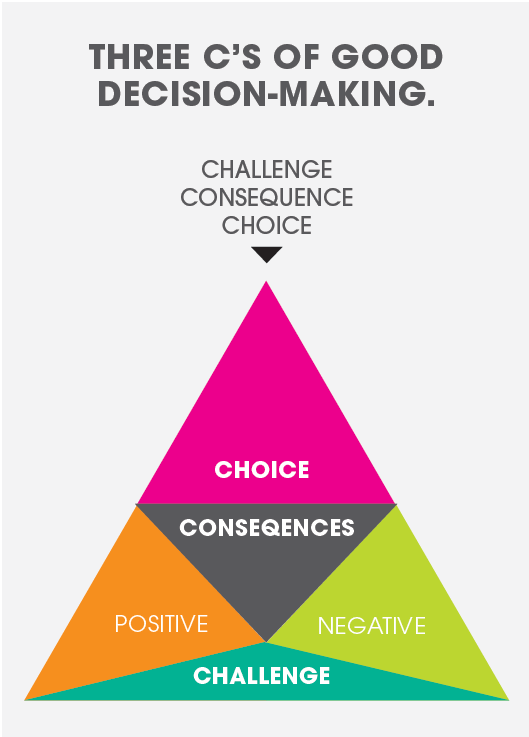

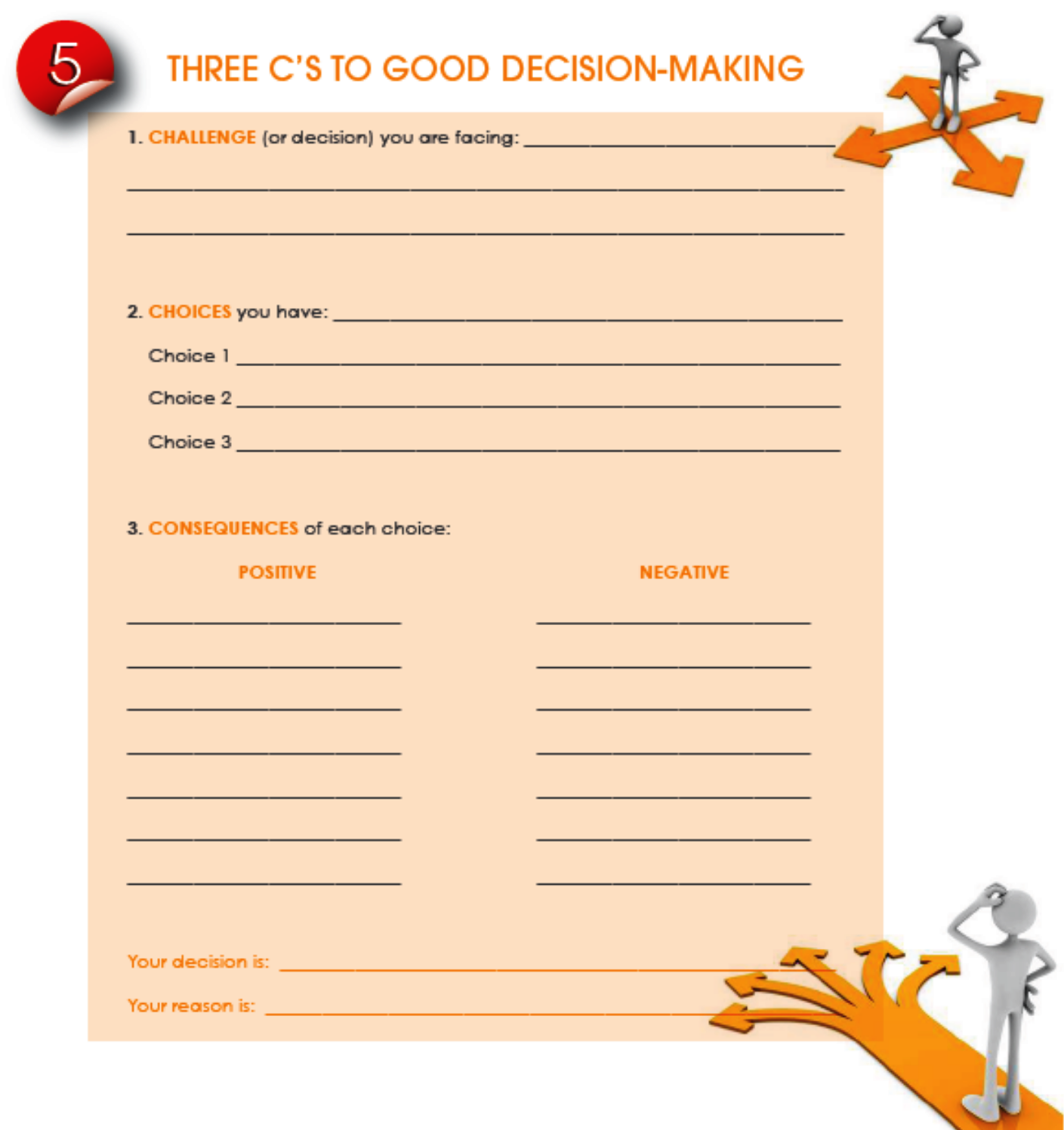

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Three C’s to Good Decision-Making[/heading]

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Activity: Three C’s to Good Decision-Making[/heading]

Recap

- People have needs and wants, which vary from time to time and person to person

- Lifestyle choices and values affect needs and wants

- It is important to set spending priorities so that you will have money for the things you really need and want

- Many factors influence how you spend, including emotions, habits and peer pressure.

- By managing wants and focusing on priorities, people can begin to manage their money

- It is also important to understand the value of analysing options and prioritising in terms of opportunity cost – as you forego one option for another.

[heading tag=”h2″ align=”center” color=”#000″ style=”lines” color2=”#000″]Activity Sheets for Download[/heading]

- Activity 1 – Needs vs Wants and Priorities

- Activity 2 – Spending decisions Quiz

- Activity 3 – Quick Quiz

- Activity 4 – 3 Cs